Rockridge Files Management Information Circular for Annual General and Special Meeting of Shareholders to Approve Business Combination with Eros Resources and MAS Gold

December 2, 2024

Vancouver, BC – Rockridge Resources Ltd. (TSX-V: ROCK) (OTCQB: RRRLF) (Frankfurt: RR0) (“Rockridge”) (the “Company”) is pleased to announce that it has filed and has commenced the delivery of the joint management information circular of the Company, Eros Resources Corp. (“Eros”) and MAS Gold Corp. (“MAS Gold”) dated November 26, 2024 (the “Circular”) and related materials for the annual general and special meeting of shareholders of the Company (the “Meeting”) to approve, among other things, the previously announced three-way merger transaction (the “Transaction”), pursuant to which, Eros will acquire (i) all of the issued and outstanding shares of Rockridge by way of plan of arrangement under the Business Corporations Act (British Columbia) (the “Rockridge Arrangement”) and (ii) all of the issued and outstanding shares of MAS Gold that it does not already own by way of plan of arrangement under the Business Corporations Act (British Columbia) (the “MAS Arrangement”).

Pursuant to the Transaction, shareholders of Rockridge will receive 0.375 common shares of Eros (each full share, an “Eros Share”) for each Rockridge common share (a “Rockridge Share”) held and shareholders of MAS Gold will receive 0.25 Eros Shares for each MAS Gold common share (a “MAS Gold Share”) held. Upon closing of the Transaction, existing Eros shareholders will own approximately 42.37% of the combined company, existing MAS Gold shareholders will own approximately 37.33% of the combined company, and existing Rockridge shareholders will own approximately 20.30% (based on the current issued and outstanding shares of each of the companies).

Benefits of the Transaction:

- Proven Leadership Team: The combined company board and management will bring decades of relevant experience, with a track record of significant valuation creation for stakeholders, capital markets expertise, and technical experience.

- Mineral Resources with Exploration Potential in Saskatchewan, Canada: The combined company will consist of high-grade gold and copper assets in Saskatchewan and the portfolio of the combined company is expected to provide shareholders with exposure to approximately 77,890 hectares of mineral claims, offering the potential for new discoveries and potentially attracting larger strategic partners.

- Strong Balance Sheet to Execute on Growth Initiatives: The combined company will benefit from Eros’ portfolio of equities valued at over $7.5 million as at June 30, 2024.

The board of directors of the Company unanimously recommends that shareholders vote FOR the Transaction and related matters, for the reasons above, among other reasons discussed more fully under the heading "The Transaction – Reasons for the Transaction" in the Circular.

The Circular provides important information on the Transaction and related matters, including the background to the Transaction, the rationale for the recommendations made by the board of directors of the Company, voting procedures and how to attend the Meeting. Shareholders are urged to read the Circular and its schedules carefully and in their entirety.

The Circular and meeting materials can also be found under the Company’s profile on SEDAR+ (www.sedarplus.ca) as well as on the Company’s website at: https://www.rockridgeresourcesltd.com/investors/agm/.

Rockridge is aware that, as a result of the national strike commenced by the Canadian Union of Postal Workers on November 15, 2024 (the “Strike”), Canada Post’s operations have shut down. In order to facilitate the delivery of the Circular and related materials for the Meeting to non-registered shareholders in the event that the Strike, lockout or similar or related events prevent, delay or otherwise interrupt delivery of Circular and related materials for the Meeting to non-registered shareholders in Canada in the ordinary course by the applicable intermediaries, Rockridge will provide the Circular and meeting materials by electronic mail or by courier upon request by a shareholder to the Company at 604-558-5847 or by email at info@rockridgeresourcesltd.com.

The Meeting will be held at 1111 W Hasting Street 15th Floor, Vancouver, British Columbia V6E 2J3 on January 6, 2025 at 10:00 a.m. (Vancouver time). Shareholders of record as of the close of business on November 8, 2024 are entitled to receive notice of and vote at the Meeting.

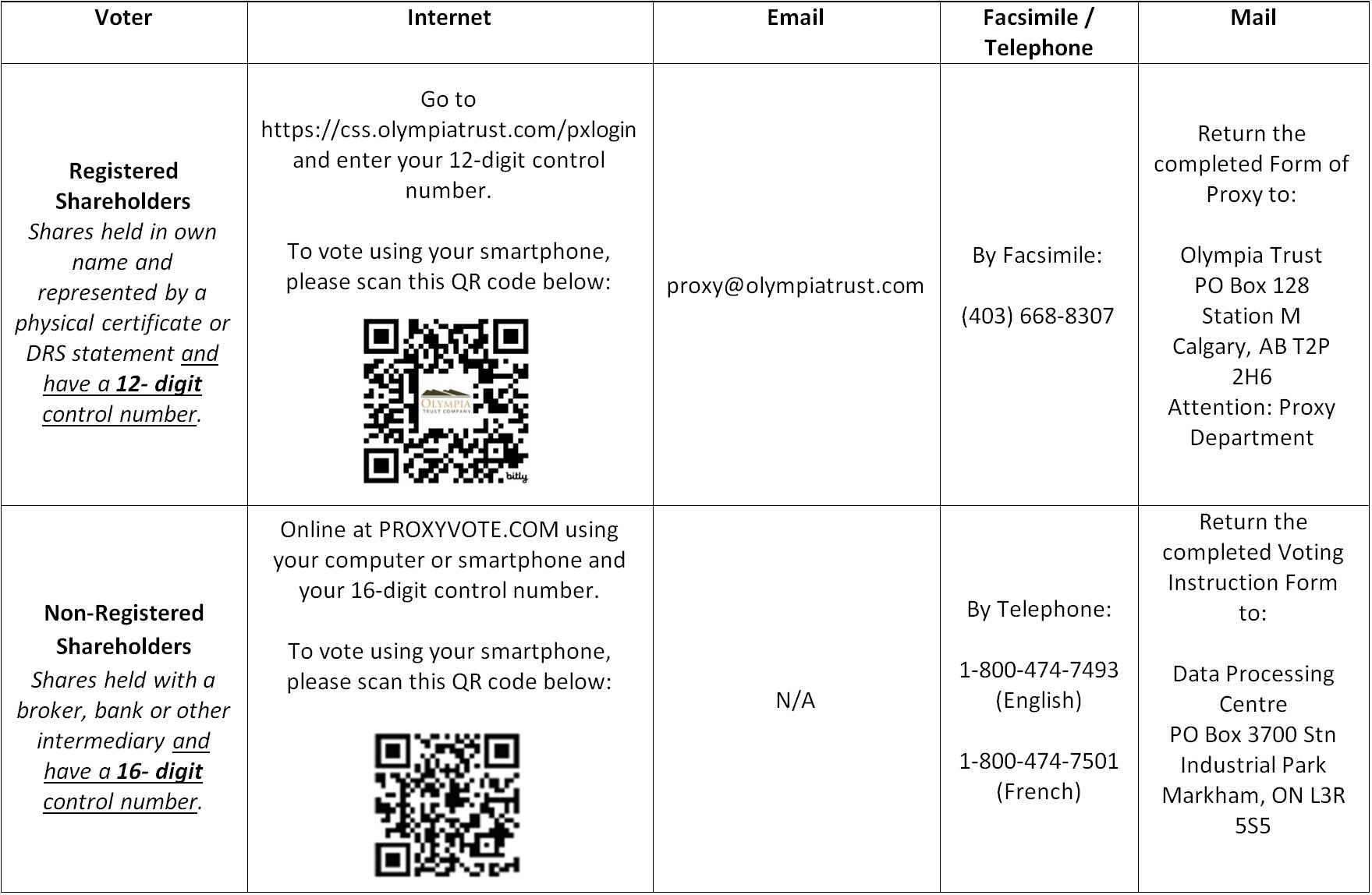

Shareholders are encouraged to vote well in advance of the Meeting in accordance with the instructions the form of proxy or voting instruction form delivered to shareholders. The deadline for shareholders to return their completed proxies or voting instruction forms is January 2, 2025 at 10:00 a.m. (Vancouver time). Note that Shareholders who hold their shares with a broker, bank or other intermediary may be required to return their voting instruction form in advance of January 2, 2025 at 10:00 a.m. (Vancouver time) to be included in the vote.

Non-registered shareholders are also encouraged to contact the proxy department at their broker or other intermediary (where their common shares are held) who can assist them with the voting process. Non-registered shareholders must follow the voting instructions provided by their broker or other intermediary and will need their specific 16-digit control number to vote.

Receipt of Interim Orders

The Company is also announcing that the Supreme Court of British Columbia has granted the interim orders in respect of the Rockridge Arrangement and the MAS Arrangement (together, the “Interim Orders”). The Interim Orders authorize various matters related to the Rockridge Arrangement and the MAS Arrangement, including the holding of meetings of shareholders of Rockridge and MAS Gold and the mailing and delivery of the Circular to shareholders of Rockridge and MAS Gold.

Additional Information

Full details of the Transaction are set out in the Business Combination Agreement, which is filed on the Company’s profile on SEDAR+ at www.sedarplus.ca.

On behalf of the Board,

Jonathan Weisblatt

CEO

About Rockridge Resources Ltd.

Rockridge Resources Ltd. is a public mineral exploration company focused on the acquisition, exploration and development of mineral resource properties in Canada, specifically copper and gold. Rockridge’s 100% owned Knife Lake Project is located in Saskatchewan which is ranked as a top mining jurisdiction in the world by the Fraser Institute. The project hosts the Knife Lake Deposit, which is a VMS, near-surface Cu-Co-Au-Ag-Zn deposit open along strike and at depth. There is strong discovery potential in and around the deposit area as well as at regional targets on the large property package. Rockridge’s gold asset is its 100% owned Raney Gold Project, which is a high-grade gold exploration project located in the same greenstone belt that hosts the world class Timmins and Kirkland Lake lode gold mining camps. Additional information about Rockridge and its project portfolio can be found on the Company’s website at www.rockridgeresourcesltd.com.

Rockridge Resources Ltd.

Jonathan Wiesblatt, CEO

Nicholas Coltura, Corporate Communications

Email: info@rockridgeresourcesltd.com

jwiesblatt@rockridgeresourcesltd.com

NEITHER THE TSXV NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

None of the securities to be issued pursuant to the Transaction have been, nor will be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor in any other jurisdiction.

Forward-Looking Information and Statements

This press release contains certain “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the beliefs of the Company regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of the Company’s control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such “could”, “intend”, “expect”, “believe”, “will”, “projected”, “planned”, “estimated”, “soon”, “potential”, “anticipate” or variations of such words. By identifying such information and statements in this manner, the Company is alerting the reader that such information and statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company and/or the combined company to be materially different from those expressed or implied by such information and statements. In addition, in connection with the forward-looking information and forward-looking statements contained in this press release, the Company has made certain assumptions. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information and statements are the following: the inability of the Company, Eros and MAS Gold to integrate successfully such that the anticipated benefits of the Transaction are realized; the inability to realize synergies and cost savings at the times, and to the extent, anticipated; the inability of the Company, Eros or MAS Gold to obtain the necessary regulatory, stock exchange, shareholder and other approvals which may be required for the Transaction; the inability of the Company to close the Transaction on the terms and timing described herein, or at all; the inability of the Company to work effectively with strategic partners and any changes to key personnel; inability of the combined company to successfully complete a private placement or other financing upon completion of the Transaction; and material adverse changes in general economic, business and political conditions, including changes in the financial markets. These risks are not intended to represent a complete list of the factors that could affect the Company and/or the combined company; however, these factors should be considered carefully. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or forward-looking statements prove incorrect, actual results may vary materially from those described herein. The impact of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and the combined company’s future decisions and actions will depend on management’s assessment of all information at the relevant time.

Although the Company believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and forward-looking statements are reasonable, undue reliance should not be placed on such information and forward-looking statements, and no assurance or guarantee can be given that such forward-looking information and forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.